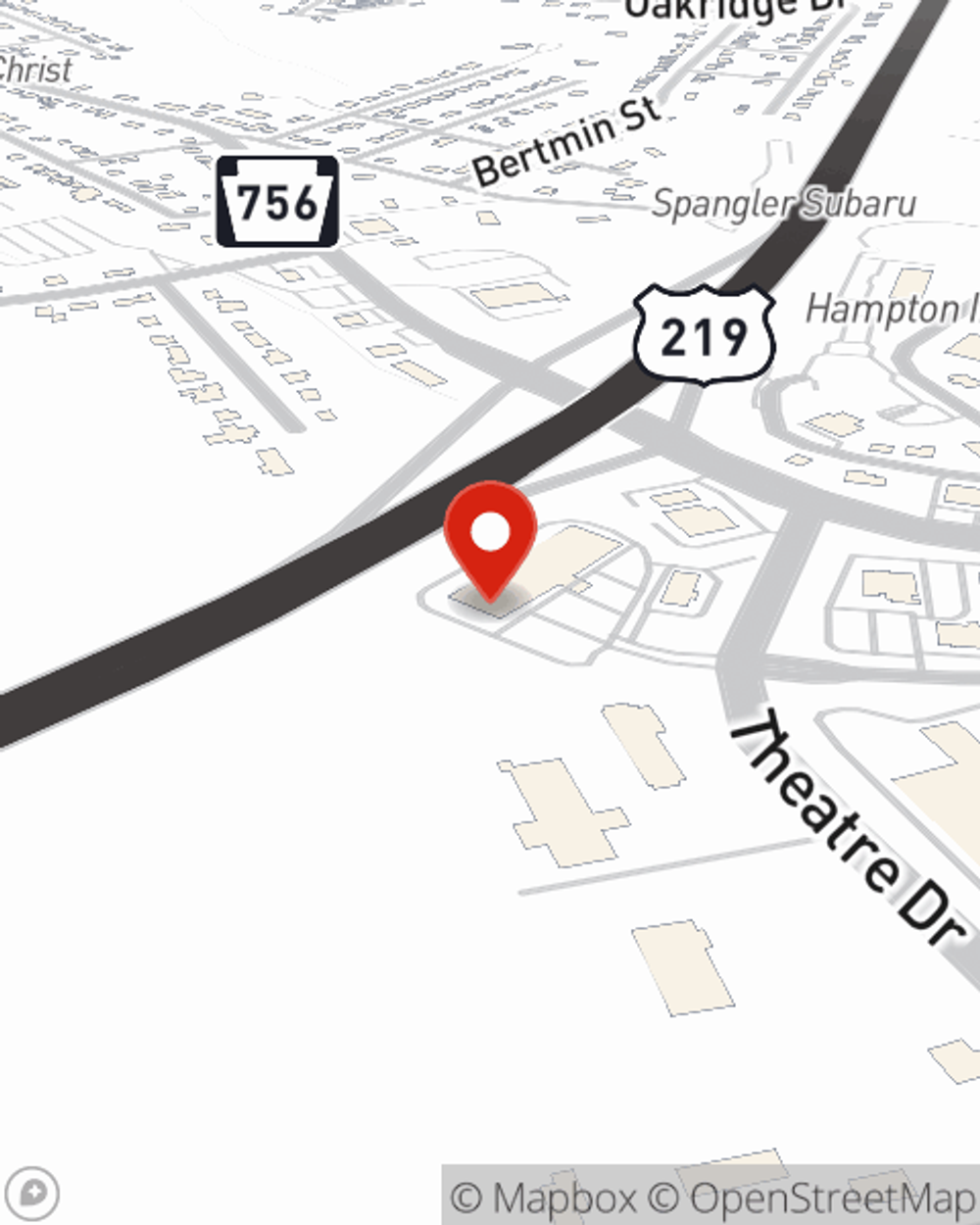

Business Insurance in and around Johnstown

Get your Johnstown business covered, right here!

Cover all the bases for your small business

Insure The Business You've Built.

Do you own a hair salon, an architect business or a barber shop? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Get your Johnstown business covered, right here!

Cover all the bases for your small business

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, artisan and service contractors or commercial liability umbrella policies.

Let's talk business! Call Michelle Octavio today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Michelle Octavio

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.